ABM, or Accountancy, Business and Management, is a field that combines the study of accounting rules, business ways, and management plans. It plays an important part in shaping today’s company world and helping organizations succeed.

Why ABM Research Matters

Because it can provide valuable insights, new solutions, and the best ways of doing things that can be used across different industries.

By doing research in ABM, scholars and professionals can find new perspectives, identify upcoming trends, and develop modern frameworks to navigate the constantly changing business environment.

This blog post aims to explore the top 21 ABM research topics for 2024, offering a full look at the most relevant and impactful areas of study within this dynamic field.

Recommended Readings: “Top 21 Research Topics Related To HUMSS (Humanities And Social Science)“.

Top 21 ABM Research Topics

Here is the list of the top 21 ABM research topics provided with the help of a diagrammatical explanation; let’s take a look.

1. Corporate Governance and Ethical Practices

- Board composition and effectiveness: Examining the structure, diversity, and decision-making processes of corporate boards.

- Executive compensation and incentive alignment: Analyzing executive pay practices and their link to organizational performance.

- Shareholder activism and stakeholder engagement: Exploring the roles and influence of shareholders and other stakeholders in corporate governance.

- Corporate codes of conduct and ethical decision-making: Studying the development and implementation of ethical guidelines and their impact on organizational behavior.

- Whistleblowing and organizational transparency: Investigating the mechanisms for reporting misconduct and promoting transparency in corporate operations.

2. Financial Reporting and Accounting Standards

- Convergence of international accounting standards: Evaluating the harmonization of accounting standards across countries and its implications.

- Fair value accounting and measurement issues: Examining the application of fair value principles and their impact on financial reporting quality.

- Revenue recognition and lease accounting: Analyzing the implementation of new revenue recognition and lease accounting standards.

- Financial statement analysis and valuation models: Developing and testing models for analyzing financial statements and determining firm value.

- Accounting for digital assets and emerging technologies: Exploring accounting treatment for new asset classes and technological developments.

3. Auditing and Assurance Services

Let’s take all the steps included in the auditing and assurance services:

1: Audit planning and risk assessment: Develop strategies for effective audit planning and identifying potential risks.

2: Internal control testing and evaluation: Assessing the design and operational effectiveness of internal control systems.

3: Substantive audit procedures and evidence gathering: Performing audit tests and collecting sufficient and appropriate audit evidence.

4: Audit reporting and communication: Preparing and communicating audit findings and opinions to stakeholders.

5: Audit quality and regulatory oversight: Enhancing audit quality through monitoring, review, and regulatory oversight.

4. Taxation and Compliance

Tax Planning and Avoidance Strategies:

A. Corporate tax strategies: Exploring legal strategies for minimizing corporate tax liabilities.

B. Individual tax planning: Analyzing tax planning opportunities for individuals and households.

C. Transfer pricing and international taxation: Examining transfer pricing practices and cross-border tax implications.

II. Tax Policy and Reform:

A. Tax incentives and economic growth: Evaluating the impact of tax incentives on economic development and business investment.

B. Tax administration and compliance: Improving tax administration processes and promoting taxpayer compliance.

C. Tax equity and fairness: Analyzing the equity and distributional effects of tax policies.

5. Risk Management and Internal Controls

Timeline:

Phase 1: Risk identification and assessment: Identifying potential risks and evaluating their likelihood and impact.

Phase 2: Risk mitigation and control design: Developing and implementing strategies to mitigate identified risks.

Phase 3: Risk monitoring and reporting: Continuously monitoring and reporting on risk exposures and control effectiveness.

Phase 4: Risk governance and oversight: Establishing governance structures and oversight mechanisms for risk management.

Phase 5: Continuous improvement and adaptation: Regularly reviewing and adapting risk management processes to changing conditions.

6. Strategic Management and Business Planning

Table:

| Topic | Description |

| Strategy Formulation | Developing long-term plans and objectives aligned with organizational goals and resources. |

| Environmental Analysis | Assessing external (e.g., market, competitive) and internal (e.g., strengths, weaknesses) factors influencing strategy. |

| Strategic Implementation | Executing and monitoring strategic plans, allocating resources, and aligning organizational activities. |

| Strategic Leadership | Guiding and aligning organizational efforts toward strategic objectives through effective leadership. |

| Strategic Agility | Adapting strategic plans and decision-making processes to rapidly changing business landscapes. |

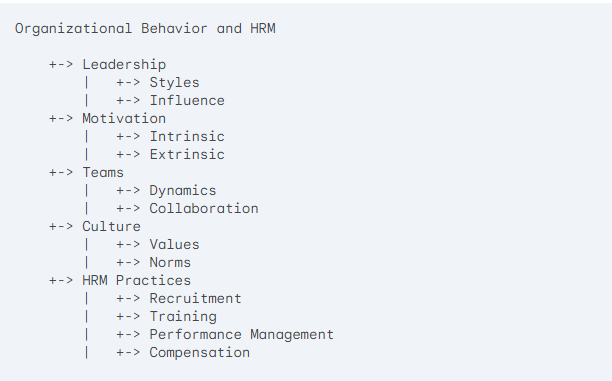

7. Organizational Behavior and Human Resource Management

Mind Map:

Organizational Behavior and HRM

- Leadership

- Styles

- Examining different leadership approaches and their effectiveness.

- Influence

- Exploring how leaders influence and motivate followers.

- Styles

- Motivation

- Intrinsic

- Studying internal drivers of motivation, such as personal growth and satisfaction.

- Extrinsic

- Analyzing external motivators, such as rewards and recognition.

- Intrinsic

- Teams

- Dynamics

- Investigating team formation, cohesion, and interpersonal relationships.

- Collaboration

- Enhancing team collaboration, communication, and decision-making processes.

- Dynamics

- Culture

- Values

- Examining the shared values, beliefs, and norms within organizations.

- Norms

- Exploring the unwritten rules and expectations that shape organizational behavior.

- Values

- HRM Practices

- Recruitment

- Attracting and selecting the right talent for organizational needs.

- Training

- Developing employee skills and knowledge through training programs.

- Performance Management

- Evaluating and improving employee performance and productivity.

- Compensation

- Designing fair and competitive compensation and benefits systems.

- Recruitment

This format clarifies the hierarchy of topics and uses clear bullet points for better readability.

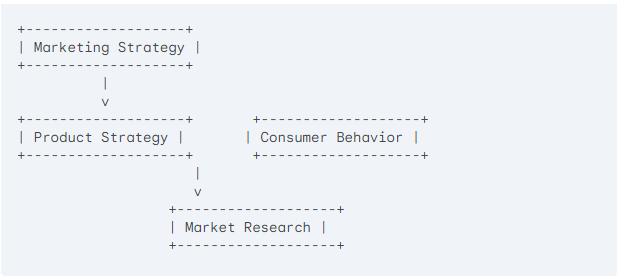

8. Marketing Strategies and Consumer Behavior

Marketing Strategy: This is the central box, representing the overall plan for how a company will reach its target audience and achieve its marketing goals.

Product Strategy & Consumer Behavior: These two boxes are positioned side-by-side because understanding both is crucial for crafting a successful marketing strategy.

- Product Strategy: This focuses on what the company is offering. It involves defining the product’s features and benefits and positioning it within the market.

- Consumer Behavior: This delves into how potential customers think, feel, and act when making purchasing decisions. By understanding consumer behavior, companies can tailor their marketing messages and strategies to resonate with their target audience.

Market Research: This box sits below the other two, highlighting its role as a foundation for the marketing strategy. Market research involves gathering information about the target market, competitors, and industry trends. This data informs both the product strategy and understanding of consumer behavior, ultimately leading to a more effective marketing strategy.

9. Supply Chain Management and Logistics

- Cycle: This illustrates the typical flow of a product or service within a supply chain.

- Procurement: Acquiring raw materials and resources.

- Inventory Management: Optimizing stock levels to meet demand.

- Production Planning: Scheduling and managing the production process.

- Distribution & Logistics: Delivering the finished product to customers.

- Customer Service & Feedback: Providing customer support and gathering feedback to improve the cycle.

Highlighted Element:

- Supply Chain Optimization and Integration: This emphasizes the importance of streamlining and connecting all these stages for greater efficiency and effectiveness.

In essence, the diagram shows a typical supply chain with a focus on optimizing and integrating all the steps for a smoother flow.

10. Operations Management and Process Optimization

This checklist outlines key areas for improving a manufacturing process. Here’s a shorter version with the same meaning:

Manufacturing Process Improvement Checklist:

- Optimize Flow: (combines Process Mapping & Capacity Planning)

- Reduce Waste: (combines Lean Manufacturing & Automation)

- Ensure Quality: (Quality Management & Control)

- Continuous Improvement: (combines Continuous Improvement & Kaizen)

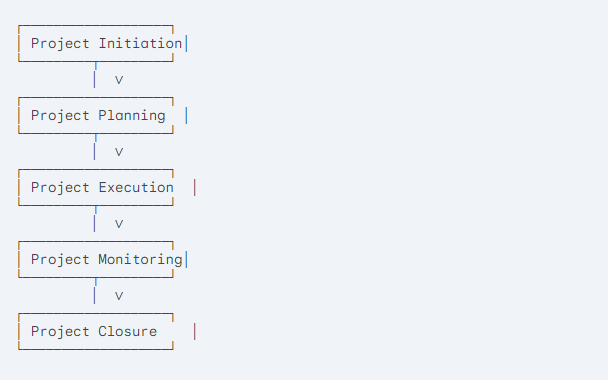

11. Project Management and Change Management

A project lifecycle diagram, which depicts the five phases of a project:

- Project Initiation

- Project Planning

- Project Execution

- Project Monitoring

- Project Closure

The arrows illustrate the sequential nature of these phases, where each phase typically leads to the next. The diagram also highlights that project closure is the final phase of the project lifecycle.

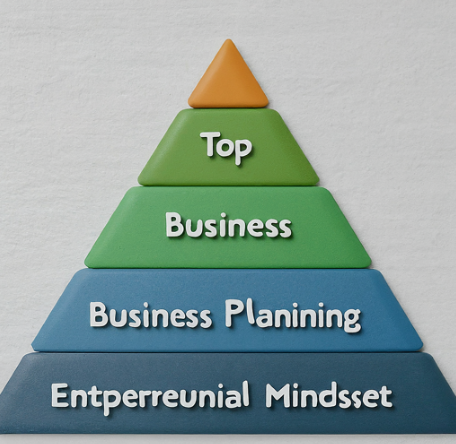

12. Entrepreneurship and Small Business Development

Pyramid Programme:

- Entrepreneurial Mindset: This forms the base of the pyramid, representing the essential characteristics and skills required for business success, such as initiative, creativity, and risk-taking.

- Opportunity Identification: Situated above the mindset, it emphasizes the importance of recognizing and capitalizing on business opportunities.

- Business Planning: Rests on opportunity identification, highlighting the need to develop a comprehensive plan to achieve business goals.

- Business Growth: Crowns the pyramid, representing the ultimate objective of any business venture.

The diagram portrays a sequential relationship, where a strong entrepreneurial mindset is the bedrock for identifying opportunities, which in turn inform effective business planning, ultimately leading to business growth.

13. International Business and Global Trade

This code uses various special characters to represent the pyramid:

▲represents the peak of the pyramid (Business Growth)/ \represent the slanted sides of the pyramid-represents the base of the pyramid|represents the vertical lines separating the text within the pyramid

This code achieves a similar visual representation as the original pyramid using ASCII characters.

14. Financial Management and Investment Analysis

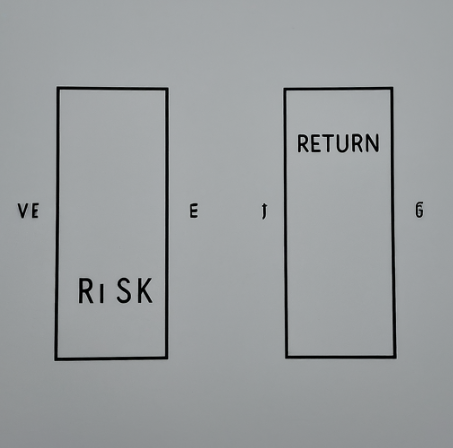

Balance Scale:

The balance scale you provided effectively illustrates the relationship between risk and return on investments. Here’s a breakdown:

- Top Pans:

- Risk: This pan represents the potential for loss associated with an investment. The larger the pan, the greater the perceived risk.

- Return: This pan represents the potential gain associated with an investment. The larger the pan, the greater the expected return.

- Center Bar: This horizontal bar symbolizes the balancing act between risk and return. Investors generally seek to maximize their return while keeping risk within acceptable limits.

- Weight: The solid black area in the middle represents the current balance between risk and return in a specific investment.

Interpretation:

- If the weight leans towards the “Risk” pan, it suggests a potentially higher risk for the expected return.

- If the weight leans towards the “Return” pan, it suggests a potentially higher reward for the level of risk undertaken.

- A perfectly balanced weight signifies an equal distribution of risk and return.

This diagram provides a simple yet effective way to visualize the risk-return trade-off in investments.

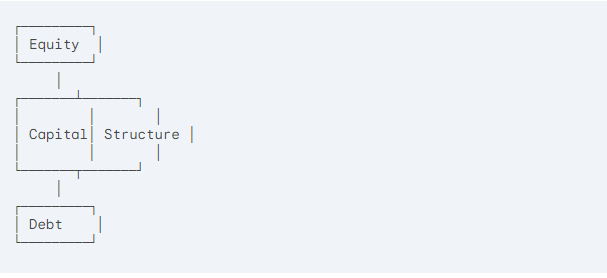

15. Corporate Finance and Capital Structure

Capital Structure

Capital structure refers to the way a company finances its operations and assets through a combination of various funding sources. The two main categories of capital structure are:

- Equity: Equity financing represents the funds raised by issuing shares of ownership in the company. Shareholders are the owners of the company and have a residual claim on the company’s profits after all other obligations have been paid.

- Debt: Debt financing involves borrowing money from lenders such as banks or issuing bonds. Debt providers are creditors of the company and have a contractual claim on a fixed interest rate payment.

The diagram shows “Equity” at the top, representing the most senior source of capital. Below that is “Capital Structure”, indicating that the financing choices influence the overall capital structure. Finally, “Debt” is positioned at the bottom, signifying that debt financing is subordinate to equity financing.

The relative proportion of equity and debt financing in a company’s capital structure can significantly impact its financial performance and risk profile. Companies need to carefully consider the optimal capital structure to balance the benefits and drawbacks of each financing source.

16. Business Intelligence and Data Analytics

- Data Collection: This is the initial step where data is gathered from various sources, such as databases, sensors, or web scraping.

- Data Preprocessing: Raw data often needs cleaning and preparation before analysis. This stage might involve handling missing values, formatting inconsistencies, and removing errors.

- Data Analysis: Here, the cleaned data is analyzed using statistical methods, machine learning algorithms, or other techniques to uncover patterns and trends.

- Data Visualization: The results of the analysis are presented visually using charts, graphs, or other visual elements to communicate insights effectively.

- Decision Support: The ultimate goal is to use the insights gained from data to inform decision-making processes within an organization.

This pipeline highlights the sequential nature of data exploration, where each step builds upon the previous one to transform raw data into actionable knowledge.

17. Information Systems and Digital Transformation

Representing a system architecture in the form of a stack. Here’s a breakdown of the layers:

- Infrastructure: This forms the foundation of the stack, representing the physical or virtual resources that provide the underlying platform for the entire system. This might include servers, storage devices, and network components.

- Data Management: This layer sits on top of the infrastructure and is responsible for storing, retrieving, managing, and securing data used by the system.

- Integration Layer: This layer facilitates communication and data exchange between different parts of the system, potentially including external systems as well.

- Application Layer: This layer consists of the core functionalities and business logic of the system. It interacts with the integration layer to access data and provide services to the user interface.

- User Experience: This layer rests on top of the application layer and represents the user interface through which users interact with the system. It focuses on providing a user-friendly and intuitive experience.

18. Sustainability and Corporate Social Responsibility

Tripple Bottom Line:

- People: This is the top section of the code, signifying the social aspect of TBL. It emphasizes the importance of considering the impact of a business on its employees, customers, communities, and society as a whole.

The Triple Bottom Line typically consists of three parts:

- People: As mentioned above, this focuses on the social and ethical considerations of a business.

- Planet: This addresses the environmental impact of a business, including its resource consumption, pollution generation, and sustainability practices.

- Profit: This remains a crucial aspect, representing the financial performance and viability of the business.

The concept behind TBL is that businesses should strive for success by considering not just their profits but also their social and environmental responsibility. This is often depicted as a three-part Venn diagram where the circles representing People, Planet, and Profit overlap, highlighting the interconnectedness of these aspects.

19. Business Law and Regulatory Compliance

- Regulations: This sits at the top, representing the laws and rules set by governing bodies that define legal boundaries.

- Compliance: This occupies the middle section, signifying the act of adhering to those regulations. Businesses strive for compliance to avoid legal issues.

- Legal Risk: The bottom section depicts the potential consequences of failing to comply with regulations, such as fines, penalties, or lawsuits.

This simple picture effectively illustrates the relationship between regulations, compliance, and legal risk. By adhering to regulations (top), businesses achieve compliance (middle) and minimize legal risk (bottom).

20. Innovation and Technology Management

Let’s understand the funnel! Here’s a breakdown of the stages:

- Idea Generation: This is the broadest stage at the top of the funnel. It focuses on fostering creativity and generating a large volume of innovative ideas. Techniques like brainstorming, user research, and competitor analysis can be used here.

- Concept Development: As ideas move down the funnel, they become more refined and evaluated. This stage involves assessing the feasibility, desirability, and viability of potential innovations. Here, ideas are shaped into more concrete concepts.

- Prototyping and Testing: This stage involves building prototypes, which are early-stage representations of the innovation. These prototypes can be used to test the concept with potential users, gather feedback, and refine the design before full-scale development.

- Commercialization: This is the final and narrowest stage of the funnel. It represents the process of bringing the innovation to market. This involves activities like product development, marketing, sales, and launch strategies.

The funnel shape illustrates the filtering process. Many ideas are generated initially, but only a select few make it through each stage, ultimately leading to successful commercialization.

21. Leadership and Organizational Development

- Personal Development: This forms the base of the pyramid, signifying the foundation for strong leadership. It emphasizes the importance of leaders continuously developing their own skills, knowledge, and capabilities to be effective in their roles.

- Team Development: Building upon personal development, this layer focuses on fostering collaboration and creating high-performing teams. Leaders play a crucial role in promoting teamwork, communication, and a shared vision within the team.

- Influence: This layer emphasizes the ability of leaders to inspire and motivate others. Leaders use their influence to guide and encourage team members to achieve organizational goals.

- Vision: Crowning the pyramid is “Vision.” A strong leader develops and communicates a compelling vision that provides direction, purpose, and inspiration for the organization.

This pyramid highlights the importance of a layered approach to leadership. Leaders need to invest in their own development first, then build strong teams, influence their team members, and ultimately set a clear vision for the organization.

Closing Up

In the end, account-based marketing will still be an important strategy for businesses selling to other businesses as we move into 2024. The top research topics covered show how ABM is changing and areas that need more research. Using AI and machine learning well to better find, understand, and engage with key accounts will be very important.

Clearly, tying ABM efforts to revenue earned is still a tricky analytical challenge. Understanding the role of personal branding and social media selling in the ABM world is not very well explored yet. As companies spend more on ABM, carefully measuring its precise impact and return on investment will require thorough research.

While ABM is now commonly used, there are still many opportunities to improve and optimize strategies through careful analysis of new trends, technologies, and proven best practices. Those leading ABM research topics will help light the way for businesses looking to get the most out of account-based approaches.

What is ABM?

ABM stands for Accountancy, Business, and Management. It encompasses a wide range of disciplines that focus on the financial, operational, and strategic aspects of organizations.

Why is ABM research important?

ABM research is important because it helps businesses understand and navigate complex challenges, improve efficiency, and drive innovation. It also provides valuable insights for policymakers, educators, and practitioners.

How can I choose a research topic in ABM?

To choose a research topic in ABM, consider your interests, the current trends in the field, and the relevance of the topic to real-world business challenges. Reviewing recent publications and attending conferences can also inspire.