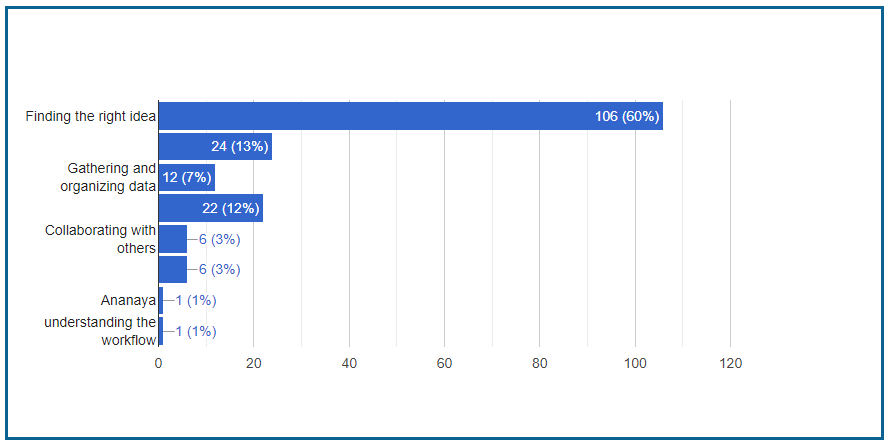

Survey Results: Challenges in Choosing the Right Project Idea

We recently polled 178 people and noticed that many struggled to select the best project idea. The majority of participants said they needed help choosing a project.

In today’s fast-paced business world, accounting is much more than just crunching numbers; it’s a key player in shaping decisions that drive success. As the industry continues to evolve with new technologies and global challenges, the need for fresh and innovative research in accounting has never been greater. This is especially true for students who are gearing up to enter the workforce. They must stay ahead of the curve by understanding the latest issues and opportunities in the field.

In this article, we’ll share over 245+ innovative accounting research topics specifically designed for students in 2024. These topics reflect what’s happening in the industry right now and encourage students to think outside the box. Whether you’re interested in financial accounting, managerial strategies, or forensic accounting, this guide will inspire you to embark on a meaningful research journey. Let’s dive into the world of accounting research and uncover the topics that could shape your academic and professional path.

What Are Accounting Research Topics?

Accounting research involves a careful examination of accounting practices, theories, and methods to understand better areas like financial reporting, auditing, and taxation. Researchers use both qualitative and quantitative approaches to tackle important issues and uncover insights that can help improve decision-making and ensure compliance with regulations. This research can take various forms, including studies based on real-world data, theoretical explorations, case studies, and comprehensive literature reviews.

Some key questions that guide accounting research might include:

- How do changes in regulations affect financial reporting?

- What role does technology play in modern auditing?

- How can accounting practices adapt to address sustainability challenges?

By answering these questions, accounting research provides valuable knowledge that benefits both the academic community and the business world.

Relevance to Students and Professionals

For students, diving into accounting research is a crucial part of their education. It equips them with the skills needed to analyze financial data critically, grasp complex concepts, and apply theoretical knowledge in real-world situations. Engaging in research not only sharpens their analytical abilities but also enhances their problem-solving skills, making them more competitive in the job market.

Staying current with accounting research is essential for professionals. It helps them keep up with industry trends and best practices, allowing them to adapt to new regulations and technological changes. Those who engage in research contribute to the field’s ongoing development, influencing important policy decisions and setting industry standards.

The Importance of Innovative Research Topics

In our fast-changing business environment, focusing on innovative research topics is vital for moving accounting practices forward. These topics not only reflect what’s happening in the industry but also encourage fresh perspectives on accounting challenges. Here are a few reasons why innovative research matters:

- Addressing Current Challenges: Innovative themes enable students and professionals to address critical accounting concerns such as the emergence of digital currencies, artificial intelligence’s influence on audits, and the difficulties of environmental reporting. Exploring these topics results in meaningful and timely solutions.

- Fostering Originality: Working with new ideas encourages creativity and critical thinking. Innovative research pushes researchers to venture into uncharted territory, promoting originality that can lead to significant advancements in accounting practices.

- Shaping the Future: Research that emphasizes innovation can significantly influence the future of accounting. By looking at emerging trends and technologies, researchers can propose new frameworks, standards, and strategies that enhance how accounting is done.

- Boosting Career Opportunities: Researching unique themes may help students stand out while entering the employment market. Employers value individuals who demonstrate initiative and a desire to try new things. Participating in cutting-edge research exhibits flexibility and a proactive mindset, both of which are highly desired in today’s workplace.

Best 245+ Innovative Accounting Research Topics For Students In 2024

- Explore the role of financial literacy in enhancing personal money management.

- Investigate how corporate social responsibility impacts overall business profitability.

- Analyze the effects of interest rate changes on consumer spending habits.

- Examine how financial regulations shape various investment strategies.

- Discuss the importance of ethical decision-making in financial management.

- Assess the role of technology in transforming traditional accounting practices.

- Delve into how globalization influences financial markets and investment.

- Study the impact of behavioral finance on individual investment decisions.

- Investigate how effective financial planning contributes to personal wealth accumulation.

- Explore the relationship between financial reporting and investor confidence.

- Analyze the effects of inflation on savings and investment behavior.

- Discuss the importance of risk management in making financial decisions.

- Evaluate the role of accountants in maintaining organizational transparency.

- Investigate how economic policies affect business growth and sustainability.

- Explore the challenges of tax compliance in an increasingly globalized economy.

- Research how corporate governance affects indicators of business performance.

- Assess the effectiveness of financial audits in detecting fraud and mismanagement.

- Examine how cultural differences influence accounting practices across countries.

- Discuss the significance of ethical leadership in enhancing corporate reputation.

- Investigate the implications of technology on modern auditing practices.

- Analyze how demographic changes affect financial reporting standards.

- Explore the role of financial analysts in guiding investment decisions for firms.

- Study the impact of social media on corporate financial communication strategies.

- Assess how environmental sustainability influences corporate finance decisions.

- Discuss the value of including financial education in school curricula.

- Investigate the relationship between corporate strategy and financial performance.

- Analyze the effects of political instability on financial markets and investments.

- Explore the significance of diversification in investment portfolios.

- Study the challenges of adapting accounting practices to new regulations.

- Discuss the role of accountants in promoting economic stability through transparency.

- Examine the influence of macroeconomic factors on personal finance management.

- Evaluate how well government incentives boost company investments.

- Investigate the relationship between tax policy and entrepreneurial growth.

- Analyze how financial technology (fintech) reshapes traditional banking services.

- Explore the challenges of ensuring audit quality in a digital environment.

- Discuss the role of accountants in risk assessment and mitigation strategies.

- Investigate the impact of corporate scandals on public trust in financial reporting.

- Analyze how interest rates affect the real estate and housing market.

- Explore the role of accountants in fostering workplace diversity and inclusion.

- Discuss the importance of transparency in public sector accounting.

- Study the implications of demographic shifts on investment strategies for businesses.

- Assess how technology transforms the management of corporate finances.

- Examine the relationship between financial performance and corporate governance.

- Investigate the role of accountants in disaster recovery and crisis management.

- Discuss the significance of ethical considerations in financial decision-making.

- Analyze how financial policies impact corporate behavior and culture.

- Explore the challenges of maintaining transparency in financial reporting processes.

- Assess the effectiveness of financial management practices in nonprofit organizations.

- Investigate how cultural values influence financial decision-making behaviors.

- Discuss the implications of regulatory compliance on accounting practices.

- Examine the role of technology in enhancing financial literacy among young adults.

- Analyze the impact of corporate governance on risk management frameworks.

- Investigate the significance of ethical behavior in financial markets and investments.

- Discuss how globalization affects tax compliance for multinational corporations.

- Explore the role of accountants in community engagement and social responsibility.

- Assess how financial performance metrics drive business strategies and decisions.

- Analyze the effectiveness of financial audits in promoting accountability and trust.

- Investigate how economic conditions influence consumer credit behavior.

- Discuss the importance of corporate accountability in enhancing investor trust.

- Explore the challenges of integrating sustainability into corporate financial strategies.

- Assess how technological advancements shape the future of financial reporting practices.

- Investigate the implications of social media on financial decision-making processes.

- Discuss the role of accountants in fostering corporate social responsibility initiatives.

- Analyze the effects of government policies on corporate governance practices.

- Explore how financial literacy empowers individuals in low-income communities.

- Examine the relationship between financial performance and employee engagement.

- Discuss the challenges of adapting accounting practices to rapid technological changes.

- Investigate the impact of corporate culture on financial outcomes and behaviors.

- Assess the effectiveness of financial management practices during economic downturns.

- Explore the role of accountants in promoting diversity and inclusion within organizations.

- Discuss the significance of risk management in corporate financial planning and strategy.

- Analyze how demographic changes affect consumer behavior in finance.

- Investigate the relationship between tax compliance and sustainable business practices.

- Assess the impact of technological innovations on traditional financial services.

- Explore the role of accountants in enhancing operational efficiency and productivity.

- Discuss the implications of cultural differences on financial reporting standards.

- Investigate the challenges of maintaining audit quality in a competitive landscape.

- Analyze the effectiveness of financial management practices in driving corporate success.

- Explore the significance of ethical leadership in enhancing corporate governance.

- Assess how economic policies impact financial decision-making processes for businesses.

- Discuss the role of accountants in navigating complex regulatory environments.

- Investigate the significance of financial performance metrics in evaluating corporate success.

- Analyze the relationship between corporate governance and investor trust levels.

- Explore how globalization affects financial planning and strategies for businesses.

- Discuss the impact of economic conditions on financial literacy initiatives.

- Assess the challenges of integrating technology into accounting education curricula.

- Investigate the role of accountants in promoting financial stability and resilience.

- Analyze how social media influences corporate finance strategies and communications.

- Discuss the importance of risk assessment in personal financial planning.

- Explore the implications of demographic shifts on corporate governance structures.

- Examine how government policies affect financial markets and investment behavior.

- Assess the effectiveness of financial education programs in schools and communities.

- Investigate the role of accountants in fostering ethical decision-making within organizations.

- Discuss the significance of transparency in financial reporting for maintaining public trust.

- Analyze the impact of corporate governance on financial performance metrics.

- Explore the challenges of adapting accounting practices to new international standards.

- Assess the effectiveness of corporate governance frameworks in enhancing transparency.

- Investigate how cultural values shape financial practices and decision-making.

- Discuss the implications of regulatory compliance on the quality of financial reporting.

- Explore the relationship between tax compliance and corporate social responsibility initiatives.

- Analyze how financial literacy impacts small business success and growth.

- Discuss the role of technology in improving financial decision-making processes.

- Investigate the significance of corporate governance in risk management strategies.

- Assess the effectiveness of financial audits in preventing corporate fraud.

- Explore how government regulations shape corporate financial behavior.

- Discuss the challenges of ensuring transparency in public sector accounting practices.

- Investigate the relationship between financial performance and employee morale.

- Analyze the implications of cultural differences on financial literacy and education.

- Explore the role of accountants in enhancing financial stability in organizations.

- Discuss the importance of ethical leadership in promoting accountability in finance.

- Examine the impact of globalization on investment strategies and decisions.

- Assess how technological advancements are reshaping the accounting profession.

- Investigate the significance of risk management in financial planning and investments.

- Analyze the effects of government regulations on corporate financial behavior.

- Explore the challenges of adapting financial practices to changing market conditions.

- Discuss the role of accountants in managing financial risks for businesses.

- Investigate how economic conditions influence consumer behavior in finance-related decisions.

- Assess the effectiveness of financial management in promoting sustainability in businesses.

- Explore the relationship between corporate culture and ethical behavior in finance.

- Discuss the implications of technological innovations on financial education and training.

- Analyze how corporate governance affects financial decision-making processes.

- Investigate the challenges of maintaining audit quality in a rapidly evolving environment.

- Explore the significance of financial performance metrics in driving business strategy.

- Discuss the role of accountants in fostering community engagement and development.

- Assess the impact of social media on corporate financial communications and transparency.

- Investigate how financial literacy programs empower individuals in underserved communities.

- Analyze the effectiveness of financial management practices in enhancing stakeholder trust.

- Discuss the importance of risk assessment in corporate financial planning and strategy.

- Explore how demographic changes affect investment behavior among consumers.

- Investigate the role of accountants in promoting ethical behavior in organizations and finance.

- Analyze the impact of interest rates on business investment decisions and strategies.

- Discuss the significance of transparency in corporate governance for stakeholder confidence.

- Investigate how technology influences traditional accounting methods and practices.

- Assess the challenges of ensuring ethical behavior in financial markets and institutions.

- Explore the role of accountants in enhancing financial literacy for diverse populations.

- Discuss the implications of economic policies on corporate strategy and decision-making.

- Analyze how cultural differences impact financial decision-making in multinational companies.

- Investigate the effectiveness of corporate governance frameworks in promoting accountability.

- Explore the challenges of adapting to rapid technological advancements in finance.

- Discuss the importance of risk management in personal finance and investment decisions.

- Assess the impact of government incentives on business growth and innovation.

- Investigate how economic conditions influence financial planning for individuals and families.

- Analyze the role of accountants in promoting diversity and inclusion within the workplace.

- Discuss the significance of ethical leadership in enhancing corporate culture and values.

- Explore the challenges of integrating sustainability into financial decision-making processes.

- Investigate the implications of technological advancements on financial reporting and analysis.

- Assess the effectiveness of financial education in empowering young adults and students.

- Discuss the importance of corporate social responsibility in shaping public perception.

- Analyze how cultural values influence investment strategies and financial behaviors.

- Explore the relationship between financial performance and corporate governance practices.

- Investigate the challenges of ensuring transparency in financial reporting for nonprofits.

- Discuss the significance of ethical decision-making in corporate finance.

- Assess the impact of globalization on financial management practices.

- Explore the role of accountants in fostering ethical practices in business.

- Analyze how economic policies influence consumer credit and lending behaviors.

- Discuss the importance of financial literacy in promoting economic stability.

- Investigate the relationship between corporate governance and investor trust.

- Assess the effectiveness of financial audits in enhancing corporate accountability.

- Explore the role of technology in improving financial education and literacy.

- Analyze how demographic shifts impact financial decision-making processes.

- Discuss the significance of risk management in investment strategies.

- Assess how government regulations affect corporate financial decisions.

- Explore the challenges of integrating technology into financial practices.

- Analyze the role of accountants in enhancing financial literacy among youth.

- Investigate the implications of demographic changes on corporate governance.

- Discuss the importance of ethical decision-making in finance.

- Assess the effectiveness of financial audits in promoting corporate accountability.

- Explore how economic policies influence consumer credit behavior.

- Analyze the relationship between corporate governance and investor confidence.

- Investigate the role of accountants in navigating complex tax regulations.

- Discuss the significance of financial performance metrics in evaluating success.

- Assess the impact of globalization on financial planning for businesses.

- Explore the challenges of adapting financial practices to changing consumer behavior.

- Analyze the effectiveness of corporate governance frameworks in enhancing financial transparency.

- Investigate how cultural values shape financial decision-making processes.

- Discuss the implications of regulatory compliance on financial reporting quality.

- Assess the role of technology in improving risk management practices.

- Explore the importance of ethical leadership in corporate governance.

- Analyze how financial literacy impacts personal investment strategies.

- Investigate the impact of government incentives on entrepreneurship.

- Discuss the significance of transparency in financial reporting for stakeholders.

- Assess the challenges of maintaining audit quality in a competitive landscape.

- Explore how financial performance metrics influence corporate strategy.

- Analyze the role of accountants in fostering ethical practices in finance.

- Investigate the implications of technological advancements on financial education.

- Discuss the importance of financial management in promoting sustainability.

- Assess how economic conditions affect financial decision-making.

- Explore the challenges of adapting to rapid changes in the financial industry.

- Examine how financial performance and corporate governance interact.

- Investigate the impact of cultural differences on financial reporting.

- Discuss the significance of risk management in corporate finance.

- Evaluate how well initiatives for financial literacy empower people.

- Explore the role of accountants in enhancing stakeholder engagement.

- Analyze how technological innovations are reshaping the financial services landscape.

- Investigate the implications of economic policies on investment behavior.

- Discuss the importance of ethical leadership in promoting accountability.

- Assess the challenges of maintaining transparency in financial reporting.

- Explore how demographic shifts impact investment strategies.

- Examine the link between organizational culture and financial performance.

- Investigate the role of accountants in improving financial stability for businesses.

- Discuss how corporate social responsibility influences financial decisions.

- Assess how globalization affects financial regulations and practices.

- Explore the challenges of ensuring ethical behavior in financial institutions.

- Analyze the importance of risk assessment in corporate financial strategies.

- Investigate the impact of technology on financial reporting and analysis.

- Discuss the significance of financial literacy in retirement planning.

- Assess the effectiveness of financial management practices in nonprofits.

- Explore how cultural differences affect investment decisions among individuals.

- Investigate how corporate governance affects financial performance.

- Discuss the implications of economic policies on corporate strategy and operations.

- Analyze the role of accountants in promoting ethical standards in finance.

- Explore the challenges of maintaining audit quality in a digital age.

- Discuss the significance of financial performance metrics in driving business success.

- Assess how technological innovations enhance financial education.

- Investigate the impact of interest rates on consumer borrowing and spending.

- Explore the importance of corporate accountability in financial reporting.

- Discuss the implications of cultural values on financial management practices.

- Analyze the effectiveness of corporate governance frameworks in risk management.

- Investigate how economic conditions influence corporate financing decisions.

- Explore the role of accountants in facilitating organizational change and adaptation.

- Discuss the significance of transparency in public sector financial reporting.

- Assess the challenges of integrating sustainability into corporate finance.

- Examine the correlation between financial literacy and economic empowerment.

- Explore how demographic shifts influence corporate financial strategies.

- Investigate the impact of government regulations on financial planning practices.

- Discuss the role of technology in enhancing financial literacy for young adults.

- Assess the effectiveness of financial education programs in schools.

- Explore the implications of globalization on corporate finance management.

- Analyze the importance of ethical behavior in financial decision-making.

- Investigate the relationship between financial performance and stakeholder trust.

- Discuss the significance of risk management in personal finance planning.

- Evaluate the effect of corporate governance on financial performance.

- Explore how cultural differences influence corporate finance practices.

- Investigate the challenges of adapting to rapid technological changes in finance.

- Analyze the role of accountants in enhancing financial transparency for stakeholders.

- Discuss the significance of financial management in meeting company objectives.

- Assess how economic policies impact consumer confidence in financial markets.

- Explore the effectiveness of financial audits in promoting corporate accountability.

- Investigate how technological advancements reshape accounting education.

- Discuss the implications of demographic shifts on investment behavior.

- Analyze the significance of ethical leadership in corporate governance.

- Explore the challenges of maintaining audit quality in a globalized economy.

- Discuss the importance of financial performance metrics in strategic decision-making.

- Assess the role of accountants in promoting financial literacy among diverse populations.

- Investigate the impact of social media on corporate financial communication.

- Discuss the significance of transparency in corporate governance practices.

- Analyze how economic conditions influence financial planning for businesses.

- Explore the challenges of integrating risk management into corporate strategies.

- Investigate the role of accountants in enhancing organizational resilience.

- Discuss the implications of technological innovations on the future of accounting.

Criteria for Selecting Accounting Research Topics

Choosing the right topic for your accounting research is essential for making your work meaningful and engaging. Here are some important factors to consider when picking your topic:

1. Relevance to Current Issues

- Industry Trends: Look for topics that address what’s happening in the accounting world today, such as sustainability reporting, the impact of blockchain technology, or how COVID-19 has changed financial practices.

- Regulatory Changes: Pay attention to any recent updates in accounting standards or regulations (like new IFRS guidelines) that need fresh analysis and discussion.

2. Interest and Passion

- Personal Interest: Choose a topic that you genuinely care about. Passion about your subject shines through in your writing and makes the research process more enjoyable.

- Stakeholder Relevance: Choose topics that appeal to practitioners and academics. Engaging both sides can lead to lively discussions and broader implications.

3. Availability of Resources

- Access to Data: Make sure you can find the necessary data and literature for your research. If a topic requires a lot of data collection, but you can’t access that information, it might become a struggle.

- Existing Literature: Check what’s already available. This will help you identify gaps in previous research that your study may complete, as well as ensure that there is sufficient information to support your subject.

4. Feasibility and Scope

- Time Frame: Consider how much time you have to complete your research. Some topics may require extensive fieldwork or analysis, which might not be feasible within your deadline.

- Narrow vs. Broad Scope: Avoid picking a topic that’s too broad, as it can lead to a superficial treatment of the subject. On the flip side, a topic that’s too narrow might not have enough depth or relevance.

5. Academic and Practical Significance

- Contribution to the Field: Aim for a topic that adds new insights or perspectives to accounting. Consider how your research might influence practices, education, or policies in the field.

- Practical Implications: Focus on topics that are relevant to businesses or policymakers. Research that addresses actual challenges tends to have a greater impact.

6. Interdisciplinary Opportunities

- Integration with Other Fields: Think about how accounting connects with other areas, such as finance, economics, or information technology. Exploring these intersections can lead to fresh ideas and broaden your research scope.

Final Words

Choosing the right research topic in accounting is an important step that sets the stage for your entire project. Focus on current issues that resonate with you and make sure you can access the resources you need to dive deep into your subject.

Think about the scope and importance of your topic. Aim for something that contributes to both academic discussions and real-world applications. Don’t hesitate to explore connections with other fields, as these can give you fresh insights and enhance your findings.

Whether you’re looking to engage in meaningful conversations within the academic community or tackle practical challenges in the industry, picking a well-thought-out topic will not only entertain your readers but also deepen your understanding of accounting. Embrace the research process with curiosity and enthusiasm, and strive to make a positive impact through your work.

FAQs

How can I determine if my research topic is too broad or too narrow?

A topic is considered too broad if it’s challenging to cover all aspects within your allotted time and word count, leading to shallow analysis. On the other hand, a topic may be too narrow if there isn’t enough existing literature or data to support a thorough investigation. Aim for a balanced scope—specific enough for detailed exploration but broad enough to find sufficient resources.

How can I ensure I have access to data for my research?

To ensure data availability, conduct preliminary research to identify potential data sources before finalizing your topic. Look for academic journals, industry reports, government publications, and relevant databases. Additionally, try reaching out to experts in the subject for ideas or data sharing, making sure your chosen topic is feasible based on the resources you can access.

Why is it important to choose a topic I’m passionate about?

Selecting a topic that genuinely interests you can make the research process more enjoyable and motivating. Your passion will come through in your writing, resulting in a more engaging and insightful final product. Additionally, your enthusiasm will drive you to explore the topic in greater depth, leading to a richer analysis.