Finance is constantly changing, and in 2024, the pace of these changes will be even faster. With new technologies, global economic shifts, and a growing focus on sustainability, there’s a lot to keep up with. Fintech is booming, ESG (Environmental, Social, and Governance) considerations are shaping decisions, and governments are updating regulations, all of which are influencing how we approach finance.

In this article, we’ve gathered 145+ finance research topics for 2024. These ideas touch on everything from corporate finance to the latest trends in fintech and sustainable investing. Whether you’re a student looking for a research topic or a professional wanting to explore new areas, you’ll find something here that sparks your interest and helps you stay ahead in the finance world.

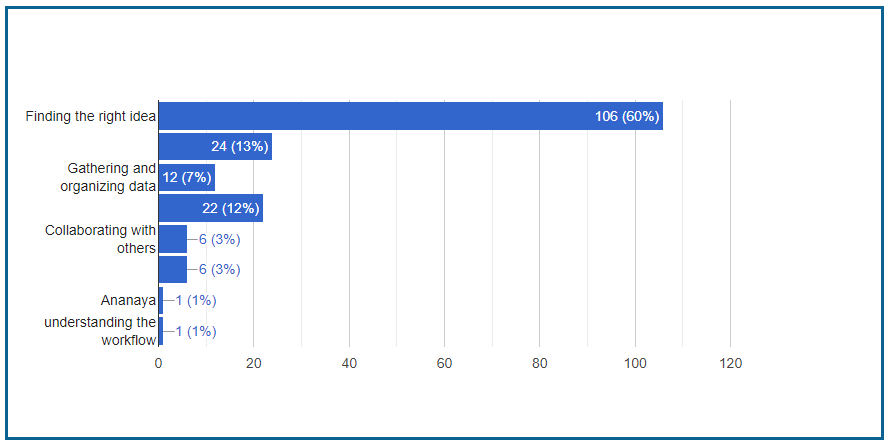

Survey Results: Challenges in Choosing the Right Project Idea

We recently polled 178 people and noticed that many struggled to select the best project idea. The majority of participants said they needed help choosing a project.

How Finance Research is Shaping Our Future in 2024

In 2024, finance research matters a lot for several key reasons:

1. Adapting to New Technology

Technology is changing how we handle money with new tools like artificial intelligence, blockchain, and fintech. Research helps us understand how these new technologies affect finance, making transactions safer and improving investment strategies.

2. Dealing with Economic Challenges

With issues like inflation and market ups and downs, research provides useful insights and strategies. It helps businesses, investors, and policymakers make better decisions in a changing economic environment.

3. Focusing on Sustainability

There’s a big push towards sustainability and ESG (Environmental, Social, and Governance) in finance. Research shows us how these practices affect financial outcomes and guide us to make investments that are good for the environment and society.

4. Understanding Global Connections

As financial markets become more interconnected, it’s important to know how global events impact them. Research helps us anticipate and manage the effects of international changes, making it easier to handle global financial issues.

5. Improving Financial Rules

Financial rules are always changing. Research helps in creating regulations that support both innovation and stability, ensuring that the rules work well in today’s financial world.

6. Making Finance Accessible

Research looks into ways to make financial services available to more people, especially those who are underserved. This helps ensure that everyone has access to financial tools and opportunities.

7. Boosting Financial Knowledge

With finance becoming more complex, understanding it is crucial. Research into financial education helps create resources that help people make smart money decisions.

In short, finance research in 2024 will help us keep up with new technologies, manage economic challenges, support sustainability, understand global markets, improve financial rules, make finance more accessible, and enhance financial knowledge. It’s key to making better decisions and navigating today’s economic world.

Top 145+ Best Finance Research Topics In 2024

Here are the Top 145+ Best Finance Research Topics In 2024

Corporate Finance

- How Capital Structure Influences Company Success

- Valuing Startups: Key Approaches

- Mergers and Acquisitions: Effects on Shareholder Wealth

- Corporate Governance’s Role in Financial Stability

- How Dividend Policies Impact Stock Prices

- Deciding on Capital Costs and Investment Choices

- Predicting Financial Trouble Before It Hits

- The Impact of Executive Pay on Company Performance

- Understanding Financial Leverage: Risks and Rewards

- Budgeting for Capital in Growing Markets

Financial Markets

- Market Efficiency and Its Oddities

- High-Frequency Trading: What It Means for Market Stability

- Stock Market Behavior During Economic Downturns

- How to Price Financial Derivatives

- The Role of Market Sentiment in Asset Pricing

- Interest Rates and Their Effect on Bond Prices

- Connecting Global Financial Markets

- How Algorithmic Trading Affects Market Liquidity

- Comparing Equity and Debt Financing

- Forecasting Market Volatility

Fintech and Innovation

- Blockchain’s Impact on Banking

- Understanding Cryptocurrency Markets

- Using Artificial Intelligence for Financial Forecasting

- Peer-to-Peer Lending: Pros and Cons

- Robo-Advisors vs. Traditional Financial Planners

- How Digital Wallets Affect Spending

- Regulatory Hurdles for Fintech Startups

- New Developments in Payment Systems

- Big Data’s Influence on Financial Decisions

- Central Bank Digital Currencies (CBDCs): What’s Next?

Behavioral Finance

- How Investor Psychology Creates Market Bubbles

- Biases That Affect Investment Choices

- Overconfidence and Its Impact on Trading

- Herd Behavior in Financial Crises

- Behavioral Insights into Saving for Retirement

- How Media Influences Investor Sentiment

- Cognitive Biases in Financial Planning

- The Role of Emotions in Risk-Taking

- Investor Behavior During Market Drops

- How Behavioral Finance Affects Corporate Decisions

Sustainable Finance and ESG

- The Role of Green Bonds in Investing Sustainably

- How Effective Are ESG Reporting Standards?

- The Impact of ESG Factors on Company Performance

- Strategies for Socially Responsible Investing

- Challenges in Measuring ESG Performance

- Risks of Greenwashing

- Integrating ESG Factors into Investment Portfolios

- Regulations Around Sustainable Finance

- How Climate Change Affects Financial Markets

- Managing ESG Risks in Investments

Risk Management

- Understanding Systemic Risk and Financial Crises

- How Stress Testing Helps Financial Institutions

- Modeling Credit Risk

- Managing Operational Risk

- Hedging Against Currency Risks

- The Role of Insurance in Managing Risks

- Liquidity Risks in Financial Markets

- Regulation’s Impact on Risk Management

- Risk Assessment in Developing Markets

- Behavioral Factors in Risk Management

Personal Finance

- Effective Strategies for Retirement Planning

- How Inflation Affects Personal Savings

- Managing Debt for Better Financial Health

- Financial Planning Tips for Millennials

- Why Emergency Savings Are Crucial

- Investment Strategies for Young Adults

- The Value of Financial Advisors

- Household Finance During Economic Recessions

- Behavioral Tips for Better Financial Management

- Choosing Between Saving and Investing

International Finance

- Effects of Exchange Rate Changes on Trade

- Investment Opportunities in Emerging Economies

- How International Trade Policies Affect Financial Markets

- Foreign Direct Investment and Economic Growth

- Managing Currency Risks for Global Companies

- The Role of International Financial Institutions

- How Global Financial Markets Are Connected

- Cross-Border Mergers and Acquisitions

- Political Risks in International Investments

- Adopting International Financial Reporting Standards (IFRS)

Public Finance

- How Fiscal Policies Influence Economic Growth

- Managing Public Debt Effectively

- Evaluating Government Spending Programs

- Best Practices in Public Sector Financial Management

- Impact of Tax Policies on Economic Behavior

- Economic Effects of Budget Deficits

- Transparency in Public Financial Reporting

- Public Finance’s Role in Economic Development

- Assessing Public Investment Projects

- How Government Regulations Affect Financial Markets

Banking Sector

- Trends in Digital Banking

- How Interest Rates Affect Bank Profits

- Challenges in Banking Regulation

- Central Banks and Their Role in Financial Stability

- Improving Customer Experience in Digital Banking

- Risk Management Practices in Banking

- Impact of Bank Mergers on Competition

- Emerging Trends in Retail Banking

- How Digital Transformation is Changing Banks

- Compliance and Risk in the Banking Sector

Investment Strategies

- Techniques for Diversifying Investment Portfolios

- Alternative Investments: Hedge Funds and Private Equity

- Impact of Asset Allocation on Investment Performance

- Effectiveness of Algorithmic Trading Strategies

- Opportunities in Emerging Market Investments

- How Behavioral Finance Influences Investment Strategies

- Economic Indicators and Their Role in Investing

- Long-Term vs. Short-Term Investment Approaches

- Balancing Risk and Return in Portfolios

- Ethical Investment Approaches

Accounting and Financial Reporting

- Impact of Accounting Standards Changes

- Importance of Clear Financial Disclosures

- Techniques for Managing Earnings

- Using Forensic Accounting to Detect Fraud

- Technology’s Role in Modern Accounting

- Comparing Financial Reporting Standards

- Accounting for Digital Assets and Cryptocurrencies

- Challenges in Reporting for Multinational Corporations

- Ensuring Transparency in Financial Reporting

- Regulatory Compliance and Its Impact on Reporting

Finance and Technology Integration

- Big Data’s Influence on Financial Decisions

- Growth of Digital Payment Systems

- Enhancing Security in Financial Services with Technology

- Fintech Innovations in Investment Management

- Using AI for Risk Assessment

- How Technology Disrupts Financial Services

- Recent Developments in Financial Technology

- Cybersecurity Risks in Fintech

- Fintech’s Role in Promoting Financial Inclusion

- Cloud Computing’s Impact on Financial Services

Emerging Markets

- Opportunities in Frontier Markets

- Economic Development Strategies for Emerging Economies

- Investment Challenges in Emerging Markets

- Impact of Political Instability on Emerging Markets

- Financial Inclusion in Developing Countries

- Role of Microfinance in Economic Growth

- Risks of Investing in Emerging Market Debt

- Infrastructure Investment in Developing Nations

- Effects of Globalization on Emerging Markets

- Sustainable Development in Emerging Economies

Miscellaneous

- Impact of Social Media on Financial Markets

- Behavioral Finance and Corporate Governance

- Technology’s Role in Managing Financial Crises

- Regulating New Financial Innovations

- Future Trends in Finance Research

- Financial Implication Of Economic

This list offers a wide range of topics to explore in the finance field for 2024, catering to various interests and aspects of finance.

Financial Challenges in Emerging Markets

- Economic Ups and Downs

- Challenge: Emerging markets can be unstable because of changing prices, political issues, and inflation.

- Impact: This can make investing risky and planning difficult for businesses.

- Political Uncertainty

- Challenge: Problems like political unrest and sudden changes in laws can shake up markets and make investors nervous.

- Impact: These issues can lead to market drops and make it harder to do business.

- Regulatory and Legal Issues

- Challenge: Rules and laws can change often and need to be more consistent, creating uncertainty.

- Impact: Companies might face legal problems or higher costs to stay compliant.

- Infrastructure Problems

- Challenge: Many emerging markets need better infrastructure, like unreliable transportation and energy and outdated technology.

- Impact: This can slow down business and increase costs.

- Difficulty Getting Finance

- Challenge: It can take a lot of work for businesses, especially smaller ones, to get funding.

- Impact: This can limit business growth and innovation.

- Currency Changes

- Challenge: Currencies in these markets can fluctuate a lot, affecting trade and investment returns.

- Impact: Businesses might face higher costs and risks due to changing exchange rates.

Financial Opportunities in Emerging Markets

- Fast Growth

- Opportunity: Emerging markets often grow quickly, creating opportunities to invest in technology, consumer products, and infrastructure.

- Impact: This can lead to good returns and more spending by consumers.

- Young and Growing Populations

- Opportunity: Many of these markets have young, growing populations that create demand for goods and services.

- Impact: This can lead to long-term market growth.

- Urban Growth

- Opportunity: As cities expand, there’s a need for more infrastructure, housing, and services.

- Impact: This opens up investment opportunities in real estate and urban development.

- Economic Reforms

- Opportunity: Many countries are making changes to attract foreign investment.

- Impact: These improvements can make it easier to do business and grow.

- Varied Investment Options

- Opportunity: There are many investment opportunities in emerging markets, such as in energy, agriculture, and technology.

- Impact: This variety can offer good returns and help spread risk.

- Tech and Innovation

- Opportunity: New technologies and business ideas are emerging rapidly.

- Impact: Businesses and investors can take advantage of these innovations for a competitive edge.

Emerging markets have both challenges and opportunities. While there are issues like economic instability, political risks, and poor infrastructure, there are also chances for high growth, young populations, and diverse investments. Understanding these factors can help investors and businesses make the most of what these markets have to offer.

Final Words

Checking out the Top 145+ Best Finance Research Topics In 2024 can really help you grasp what’s happening in emerging markets right now. These markets come with their own set of challenges, like economic ups and downs and political instability, but they also offer exciting growth and investment opportunities.

By diving into these research topics, you’ll get a clearer picture of the trends and factors influencing these markets. This understanding will help you make smarter decisions and navigate the financial landscape more effectively. Keeping an eye on the opportunities for strong returns and managing the risks will be key. So, as you explore the Top 145+ Best Finance Research Topics In 2024, you’ll be better prepared to seize the potential in these dynamic markets.

FAQs

What should I think about when picking a finance research topic?

When choosing a finance research topic, think about how relevant it is to current trends, whether there’s enough data available, and if it aligns with your interests and expertise. Pick a topic that offers useful insights and adds value to the finance field.

How do emerging markets offer both risks and rewards?

Emerging markets have risks, such as economic ups and downs, political instability, and infrastructure problems. But they also offer rewards, such as the potential for rapid growth and high returns because of their expanding economies and rising consumer demand.

How do finance research topics affect financial decision-making?

Finance research topics help shape decision-making by providing insights into market trends, investment options, and risks. This information helps investors, businesses, and policymakers make informed choices that align with their financial goals and risk tolerance.